This is Part 1 of a five-part series by Urban One, which outlines recommendations and proposals for improving the California/Los Angeles density bonus program. Part 1 focuses on background, while Parts 2 through 5 include specific recommendations to improve the density bonus and affordable housing provision throughout the region.

A while back we promised to explore in greater detail some of the topics addressed in “LA’s Next Frontier,” the LA Business Council Institute’s report that we helped UCLA’s Paul Habibi to research and write. An important part of that report was the “developer’s toolkit,” which included a variety of programmatic and procedural changes that could help address the city’s housing shortage and economic development needs. In this post and several that follow we’re going to focus specifically on the density bonus, a program that increases the supply of affordable housing by hundreds of units each year, but, as the LABC Institute report makes clear, is falling short of its true potential. Our plan for this series is to examine how the density bonus is being implemented locally and how it might be improved to get more affordable and market-rate housing built throughout the city.

But first, since the density bonus program can be challenging to understand without a bit of context, we’re going to start out this series with some general background. If you’re already familiar with how the density bonus program works, feel free to skip to Part 2.

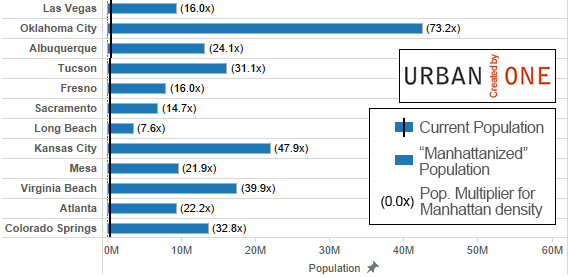

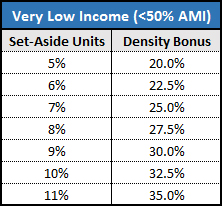

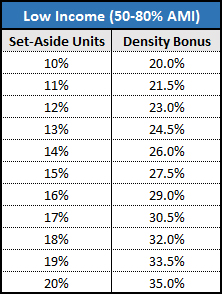

For the uninitiated, the density bonus is a state-mandated program that allows developers to build more market-rate units if they set aside a portion of their building for lower-income residents. The maximum bonus is 35 percent, so on a plot of land zoned for up to 100 residential units, a developer could build up to 135 units if they took advantage of the density bonus. To get the full 35 percent density bonus the developer would need to set aside 11 percent of the units for very-low income residents (up to 50 percent of Area Median Income, or around $33,000 for a four-person household) or 20 percent for low income residents (50 to 80 percent AMI), for a duration of at least 55 years. Additional benefits (“incentives”) can also be conveyed to developers who take part in the density bonus program, such as reductions of minimum parking requirements and leniency on building setbacks and height limits; the 35-percent density bonus can also be achieved with a somewhat smaller share of affordable units if the building is located near a major transit corridor or employment center.

Using the plot of land zoned for 100 multifamily units as an example, a developer who dedicated 11 percent of their units to very low income residents would build 11 affordable units—the 11 percent modifier applies to the pre-bonus maximum density—and in return would be granted the right to build 24 additional market-rate units at the site, for a 35 percent total density bonus. Since affordable units for very low income families can only rent for around $700-1,000 per month, depending on household size, most of the rent in affordable units is spent on maintenance and operations, and very little if any is left over to pay off the cost of construction. This is exacerbated by the ongoing costs associated with compliance, which require the owner to verify that renters in affordable units fall below a specified income threshold. As a result, the cost of building these affordable units is almost wholly subsidized by the profits earned on the additional market-rate units.

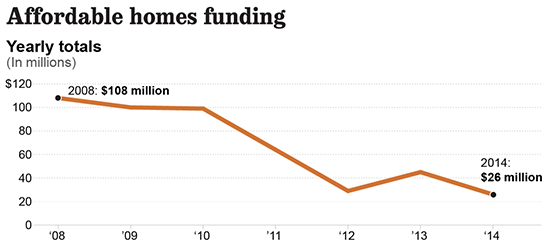

According to the LA River Report released last month, of the approximately 30,000 multifamily units constructed in Los Angeles from 2008 to 2013, slightly fewer than 1,500 were affordable density bonus units—about 5 percent. Given that the program requires 11 to 20 percent of units be affordable to receive the full 35-percent density bonus, it’s clear that a large number of developers aren’t taking full advantage of the program, and are either sticking with exclusively market-rate construction or building to less than the full 35-percent bonus. Ultimately this means fewer affordable and market-rate units, which is bad for affordability at all income levels, as more people move to LA and compete for a limited number of homes.

Why aren’t developers taking advantage of the density bonus? There are a few possible reasons. Local anti-growth politics may play a role, where in many neighborhoods the trend is to make projects smaller than is legally permissible, not larger. Another factor may be uncertainty about the density bonus process itself, and compliance costs associated with managing affordable housing. The most likely reason, though, is that the financials simply don’t work out: The additional cost of the affordable units exceeds the profit earned on the extra market-rate units, so the developer can earn a better return without the density bonus, especially when they account for the additional time/money/headache associated with the program’s approval process.

Inclusionary zoning is no longer legal in Los Angeles, so when it’s more profitable for developers to forego the density bonus and build market-rate units only, that’s what they’ll do—market realities generally preclude any other outcome in lieu of public or philanthropic organizations stepping in to fill the gap. What we as a city need to do, and what the numbers show that we’re currently failing to do, is find a way to fill that gap without relying on the charity of developers or outside organizations. This doesn’t mean giving away windfall profits, but it does mean making participation in the density bonus program at least marginally more profitable than non-participation.

This is especially important as we look to use city and county dollars efficiently in an era of scarce resources and many competing priorities. In 2009, the statewide average cost of producing affordable housing rose to $334,000 per unit; in the overheated Los Angeles housing market, that number was probably even higher. Each affordable unit constructed through the density bonus is one less unit that must be built with public funds, and there is an implicit economic cost each time a developer chooses not to participate in the program. For example, if the 100-unit builder from above loses $50,000 of profit on each of the 11 Very Low Income units (relative to the profit they would earn building exclusively market-rate, without the density bonus), they won’t build those affordable units. This saves the developer $550,000, but if each unit has a value of $300,000 when built, the city has given up $2.75 million in free affordable housing (11 x $250,000) by failing to fill that gap. Now, the city must directly subsidize its own affordable housing at a cost of $300,000 or more per unit, or rely on leveraging very limited state and federal dollars. We can’t afford to leave private money on the table.

The question that springs from all of this discussion, then, is “What can we do to restructure density bonus incentives and better achieve our affordable housing goals?” We at Urban One don’t claim to have all the answers, but we’d like to propose a few ideas that we hope can spur a discussion and, eventually, help us to create a greater supply of both market-rate and affordable housing throughout the city.

Our series continues with Part 2, where we explore the idea of reducing thresholds for participation in the density bonus program to increase affordable and market-rate housing production. Parts 3 through 5 will consider additional changes to achieve the same, all while minimizing public investment and leveraging private dollars to the greatest extent possible.