There’s more value to building hotels than just boosting tourism at the downtown convention center: The city is spending $39.2 million in foregone tax revenue to encourage Metropolis to build a hotel, but that hotel will generate $110 million more in city revenues than a similar residential tower built at the same location.

Over the past decade, developers in Downtown LA have received some big tax breaks to encourage hotel construction near the city’s convention center; with the city struggling to afford many basic services like street and sidewalk repairs, some have questioned whether this is the most responsible use of limited public funds.

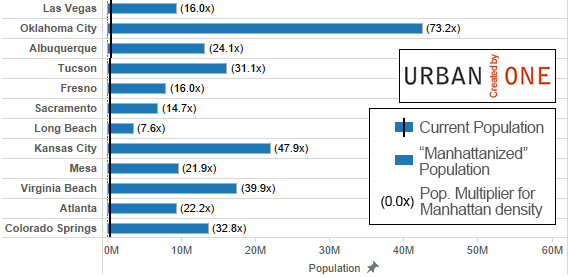

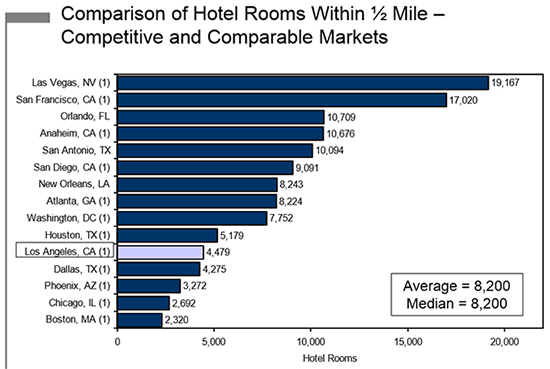

For proponents, the idea behind these subsidies is that in lieu of city assistance, developers would just build something else — something cheaper or less risky, like apartments — and that the city would lose out on hotel space needed to support the convention center and LA Live entertainment district. The need for additional hotel rooms has been the main argument in favor of these subsidies, and it’s a legitimate problem: According to a study by Conventions Sports & Leisure, Los Angeles has just 4,500 hotel rooms within a half-mile of its convention center, compared to 9,000 in San Diego, almost 11,000 in Anaheim, 17,000 in San Francisco, and over 19,000 in Las Vegas. Without sufficient hotel space in close proximity to the downtown convention center, LA can’t really compete for the biggest, most popular conventions.

The cost to the city for incentivizing these downtown hotels has been a big focus among outlets like Curbed and the LA Times, but what’s received less attention is the long-term revenue implications for the city. The Greenland Group’s Metropolis development — a billion dollar residential and hotel project just north of LA Live — was the most recent recipient of a tax rebate valued at $39.2 million over 25 years, and it’s a great case study for looking at the impact of these subsidies on the overall city budget. Greenland has one of two choices for their first phase of development, and they can reasonably go either way: build a residential tower and a hotel tower, or just build two residential towers.

According to an analysis by Keyser Marston Associates (KMA), Greenland’s 350-room hotel tower is projected to cost $13.5 million more than a second residential tower, so that’s the gap the city needs to fill to incentivize them to build a hotel instead of more housing. The amount of subsidy the city can provide is currently limited to either 50 percent of all new tax revenues (property tax, sales tax, hotel tax, etc.), or 100 percent of hotel taxes alone, whichever is less. There has been debate in the past year about revising those amounts in certain parts of the city to 25 percent and 40 percent, respectively, but there are concerns that this will make it even harder to attract the large hotel developments (e.g., 600, 800, 1000 rooms) that downtown is already struggling to attract. In this case the project’s need was fairly limited, and the city committed to providing just 25 percent of net new revenues, at a total value of $13.1 million — just shy of the feasibility gap between hotel and residential. Presumably, the Metropolis developers are willing to eat the $400,000 difference to earn some goodwill with the city.

And for those wondering how a $13.1 million funding gap becomes $39.2MM in subsidies: For the same reason that I’d gladly pay you Tuesday for a hamburger today, $13.1MM up front has the same value as $39.2MM paid out over 25 years. (For the finance nerds, $13.1 million is the 25-year net present value.) It’s also important to note that the city’s assistance only comes out of new revenues generated by the project, so even if the development was a total failure the city could never lose money.

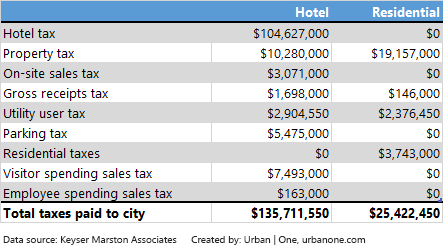

So, in the long term, $39.2 million is what it’s costing the city. What do we get in return? The key to that question is understanding that different types of projects create different types of revenues. Residential and hotel projects both generate property tax revenues for the city, but hotels generate additional revenues in the form of sales, gross receipts, and parking taxes (among others), and, most importantly, the all-mighty hotel tax. The hotel tax — also known as the transient occupancy tax or “TOT” — is hugely important for cities: it’s 14 percent of room revenues and it all goes to the city of LA. Compare that to the sales tax, of which only 1 percent actually goes to the city. Residential projects tend to be cheaper to build and produce more consistent revenues so they appeal to developers, but they don’t generate any of these additional tax revenues for the city.

Keyser Marston looked at the projected revenues if Greenland builds a 350-room hotel and a 308-unit condominium, and they estimated that the two towers would generate a total of $161 million in city revenues over 25 years. Of that total, $135 million is generated by the hotel, and $25 million by the condos. And of the $135MM generated by the hotel, $104MM comes from hotel taxes alone. Again, it’s all about the hotel tax. Here’s how the numbers break down according to KMA:

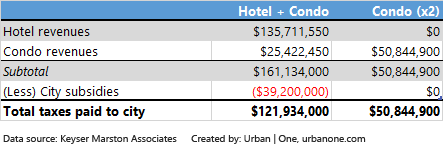

If the Greenland Group decided to build two residential towers at the Metropolis site instead of a hotel and a condo tower, the city would earn about $110 million less over the next 25 years. Even after accounting for the $39.2MM tax rebate, we’d still be about $70 million poorer. Here’s another table that compares the two scenarios:

Based on this analysis, it seems clear that there’s good reason to incentivize builders that are on the fence about building hotels. Even if you’re indifferent to the fate of Los Angeles as a major convention center and tourism destination, this is a simple economic reason to support building hotels rather than more upper-scale housing in the downtown entertainment district. In this case alone, the city can expect about $70 million additional dollars of revenue over the next 25 years compared to what we’d get from another condo tower.

At this point the astute reader will note that if the developer intended to build a hotel anyway, we just gave away $39 million for nothing. It’s a fair critique, since the way that development plans are put together involves a lot of assumptions and a lot of potential flexibility. We just can’t know for certain which of these projects, if any, might have been built with less assistance, or even none at all. But this is also the reason firms like KMA exist: to determine the extent of a developer’s need on behalf of the city, from an objective, critical perspective. Their job is to determine the “but for” value — the amount of assistance needed, but for which the hotel would not be built. It’s a tough job with a million moving targets, so really knowing that we’ve landed on the right amount is essentially impossible. What we do know, at least, is that hotels are a cash cow for the city; as long as we need the additional rooms, it might be worth sharing the bounty to ensure they continue getting built.